31st Gst Council Meeting Rate Cut Highlights

Reported under GST on 22/12/2018Today on 22/12/2018, 31st council meeting was conducted. Arun Jaitley, Finance Minister of India briefed about key points of meeting. The major highlight of meeting was rate cuts of var…

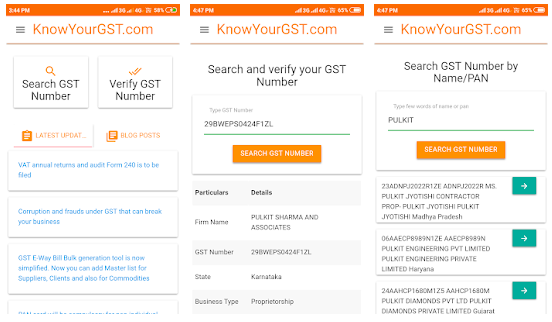

Mobile App To Search And Verify Gst Numbers

Reported under GST on 21/12/2018These Things Will Get Cheaper After Gst Council Meeting

Reported under GST on 21/12/2018Good news for consumers as prices will be cut down for most of items falling within 28% rate slab as government is planning to bring most of the items under 18% rate slab.

The upcoming G…

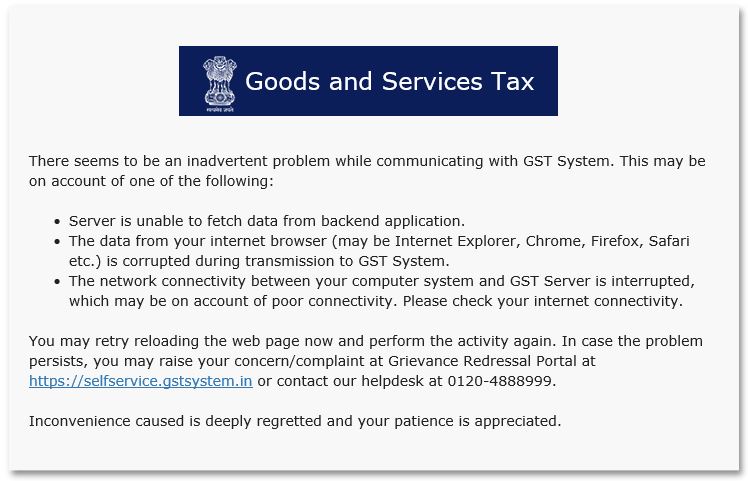

Gst Server Down Again, Taxpayers Agry

Reported under GST on 20/12/2018Today is last date to file GSTR-3B returns and GST portal is gone on sleep.

The portal is not responding and error messages are being thrown for different returns and tax payers.

…

3 Caught In A Gst Fraud Of Rs. 687 Crores

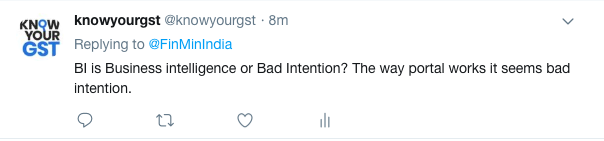

Reported under GST on 20/12/2018Gstn Will Soon Start Sending Notices For Mismatch Of Returns

Reported under GST on 18/12/2018GSTN is working on Business intelligence tools to compare data of various returns filed by Tax payers and scrutinize details. Tweet my finance minister of India Arun Jaitley indicates that Tax Pay…

Fake Invoices Fraud Detected Affecting 200 Crore Igst

Reported under GST on 18/12/2018GST department has detected a fraud which could be around 200 crore. Officials have stated that bogus trading of around 1100 crore was carried out by multiple firms in state of Madhya Pradesh, Guj…

Gst Portal Updates Use Policy, Terms And Conditions To Avoid Data Scrapping

Reported under GST on 15/12/2018GST portal has updated its user policy and terms to avoid any misuse of portal and data of tax payers.

As per sources, GSTN has received various complains of data scrapping and even site…

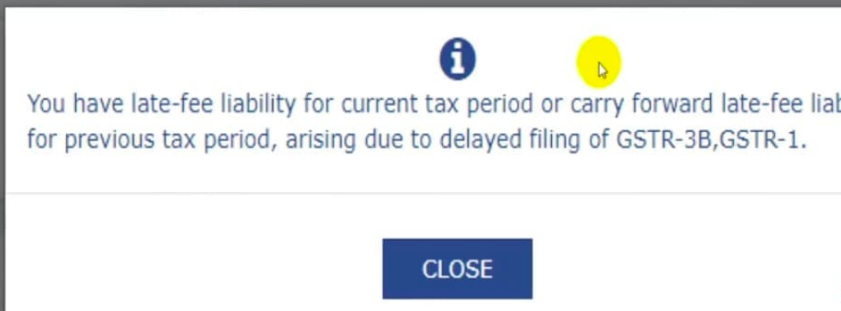

Late Fee Gstr-1 Started And Tax Payers Are Shocked

Reported under GST on 11/12/2018GST portal has started showing warning for late filing fee on GSTR-1 and late fee is being charged now. Till now late filing fee was charged only on delay in filing of GSTR-3B.

However f…

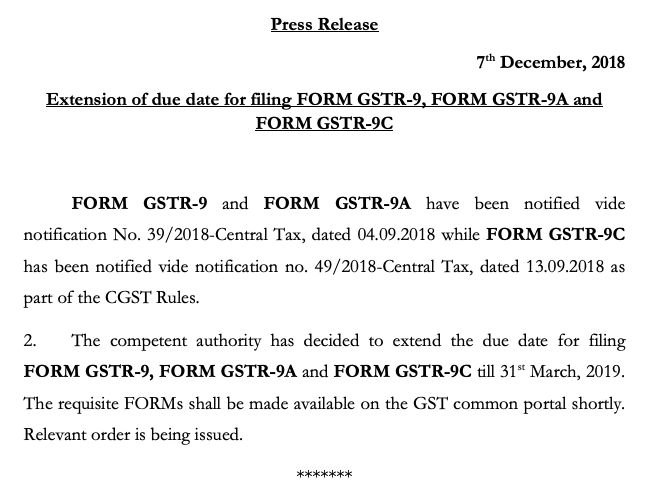

Gstr-9 Due Date Is Extended, New Due Date Is March 31,2019

Reported under GST on 08/12/2018CBIC has extended the due to file GST Annual Returns. GST annual return is a final statement for a financial year to be fil…

Gst Practitioner Exam Govt Extended Eligibility Criteria

Reported under GST on 04/12/2018The National Academy of Customs, Indirect Taxes and Narcotics (NACIN) has been authorized to conduct an examination for confirmation of enrollment of Goods and Services Tax Practitioners (GSTPs) i…

Vat Annual Returns And Audit Form 240 Is To Be Filed

Reported under GST on 30/11/2018VAT (Value Added Tax) though does not exist any more but still one need to comply with annual filings. Karnataka government has specified the dealers who need to file annual returns and audit stat…

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by