Gstn Will Soon Start Sending Notices For Mismatch Of Returns

Reported under GST on 18/12/2018GSTN is working on Business intelligence tools to compare data of various returns filed by Tax payers and scrutinize details. Tweet my finance minister of India Arun Jaitley indicates that Tax Payers will start getting notices very soon.

GSTN has started sharing data with tax authorities on the following: a.Mis-match between figures reported in GSTR-1 & GSTR-3B. b.Mis-match between figures reported GSTR-3B &that computed by the system in GSTR-2A. c.Taxpayers who have generated e-way bill but not filed tax returns

Arun Jaitley

GSTN has started to compare GSTR-3B with GSTR-1 and GSTR-2 details. Tax payers who have made E-way bills but reported in GSTR returns are also targeted.

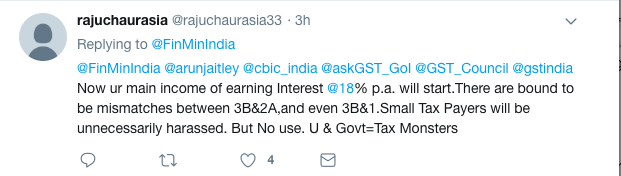

GSTN has started work on BI & Analytics. Different scenarios of BI have been identified on which work is going on such as Persona based Analysis, Predictive Analysis, Fraud/Anomaly Detection, Statistical Scoring, 360 degree view taxpayers, Circular Trading & Network Analysis etc.

Arun Jaitley

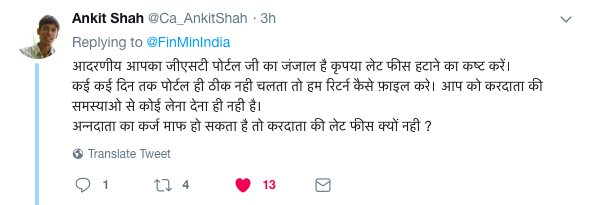

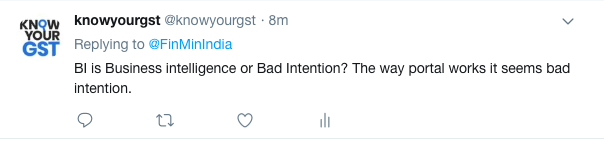

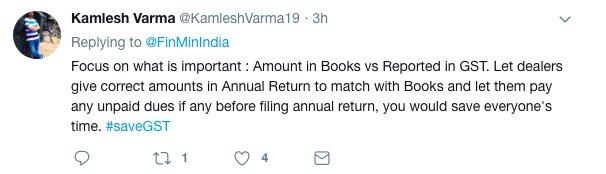

Users on Twitter have targeted Arun Jaitley for intention to harass Tax payers on name of mis-matching as GST regime is not stable yet. Half the time portal does not work and many procedure related issues are open.

GST helpline and GST Tech teams have not helped users as complaints filed are rarely solved.

Here are comments of users and KnowYourGST.

Related News

GSTR-9 and GSTR-9C due date extended

Due dates extended

GSTR9 and GSTR-9C for FY 2017-18 extended

Eway bill blocking is harassment

GST Annual return in form GSTR-9 removed

GSTR-9 and GSTR-9C due date extended

Government to refund money for technical errors to taxpayers

Forthcoming changes in e-Waybill system (Date: 25-03-2019)

GSTR-3B due date is extended

GST registration turnover limit to be increased to 40 lakhs

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by