Gstr-9 And Gstr-9c Due Date Extended

Reported under GST on 28/02/2021GSTR-9 and GSTR-9C annual returns due date has been extended to 31 March 2021.

A Press release has been released extending date.

Once again department took decision after ruini…

Due Dates Extended

Reported under GST on 24/03/2020The Finance minister in her speech today has extended various due dates.

GST points

Last date for filing March, April and May 2020 returns is being extended to June 30, 2020.…

Gstr9 And Gstr-9c For Fy 2017-18 Extended

Reported under GST on 17/12/2019Due date for Annual Return in form GSTR9 and GSTR9C is extended to 31/01/2020. Out news is again correct. Believe us, believe our sources.

As per…

Eway Bill Blocking Is Harassment

Reported under GST on 08/12/2019From December 1, 2019 a new rule came into effect. Now if a taxpayer does not file GSTR-3B return for continuous 2 months his Eway bill generation get automatically blocked.

In my opinio…

Gst Annual Return In Form Gstr-9 Removed

Reported under GST on 20/09/2019In today held GST council it has been decided to remove filing of GSTR-9 by taxpyers having turnover less than 2 crore.

It is a good news and industry was hoping for it, however even big…

Gstr-9 And Gstr-9c Due Date Extended

Reported under GST on 26/08/2019Update: We informed you in morning itself. Date has been extended. Read our news below and here are latest updates.

Elections are approaching and central government is in mood to impress GST tax payers. Businessmen are angry with government as it has charged late filing fee but did not compensate for technical …

Government To Refund Money For Technical Errors To Taxpayers

Reported under GST on 01/04/2019

Forthcoming Changes In E-Waybill System (Date: 25-03-2019)

Reported under GST on 29/03/2019The National Informatics Centre (“NIC”) has made new changes in E-Way Bill System dated March 25, 2019, which will be made effective in Next Version which will be implemented v…

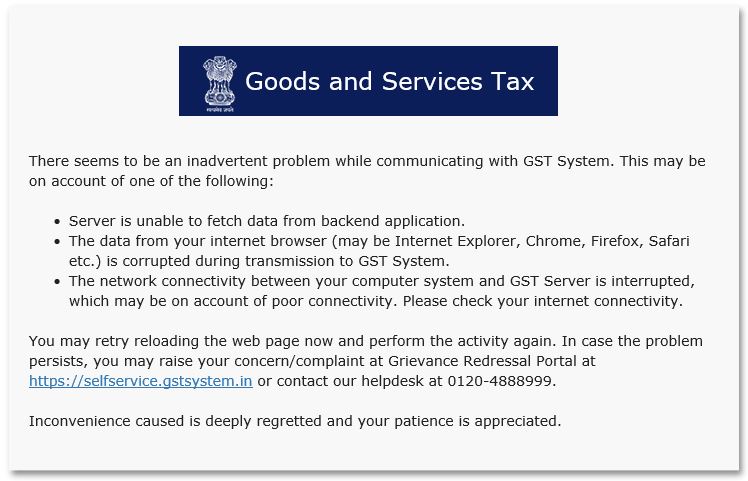

Gstr-3b Due Date Is Extended

Reported under GST on 20/02/2019Due date to file GSTR-3B which was today has been extended to 22 Feb 2019.

We have been following this matter closely and decision came after KnowYourGST twitted the difficulties faced b…

Gst Registration Turnover Limit To Be Increased To 40 Lakhs

Reported under GST on 10/01/2019In GST council meeting conducted today the major decision was to give relief to small traders.

For those dealing in Goods, turnover limit for GST registration is increased to Rs. 40 lakh…

What Is Wrong With Gst Council? A Bad Move To Further Damage Government Reputation.

Reported under GST on 03/01/2019GST council in its recent meeting decided to waive late filing fee for return from July 2017 to September 2018. However, the decision benefited those who did not file returns yet.

Those …

Due Date To File Gst Annual Returns Extended Fruther To June 2019 And Other Favorable Decisions

Reported under GST on 22/12/2018GST council in meeting held on 22 December 2018 has decided to extended due date to file GST Annual R…

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by