Gst Portal Updates Use Policy, Terms And Conditions To Avoid Data Scrapping

Reported under GST on 15/12/2018GST portal has updated its user policy and terms to avoid any misuse of portal and data of tax payers.

As per sources, GSTN has received various complains of data scrapping and even site goes down frequently due to data scrapping and site embedding GST portal.

However, our take is that GST portal instead of issuing warning and changing its policy should upgrade its portal to provide better services to tax payers.

GST portal is already competing with various private players as GSTN has issued APIs to allow private players same facilities it provides on its own portal. Due to increased cost of overall facilities and small startups, many companies are depended on short cuts to directly scrap GST portal to avoid paying for APIs.

As per updated terms and policy, unauthorised usage will be:

The term Unauthorised activities includes any activity which is punishable under section 43 (for eg web scraping, altering source code, hacking, introducing viruses etc.)and Section 45 of the Information Technology Act, 2000 (hereinafter IT Act) or which have been defined as offence under Chapter XI of The IT Act and/or any other activity which is prohibited under any Act, rules, regulations having force of law in India and/or any activity which contravenes access controls/Service use limits set by GSTN on the GST Portal and/or any security feature developed by GSTN on the GST Portal and/or any activity which is contrary to any other policies of the GST Portal.

Further GST portal has updated its terms to discourage users certain activities without prior permission of GSTN.

- Imply or state any affiliation with or endorsement of GSTN / without direct and express consent of such organisation (e.g., representing oneself as an accredited GSTN associate).

- Manipulating identifiers in order to disguise the origin of any message or post transmitted through the GST portal.

- Monitoring the GST portal's availability, performance or functionality for any competitive purposes.

- Overlaying or otherwise modifying the GST portal or their appearance.

- Removing or covering or obscuring any advertisement included on the GST portal.

- Renting, leasing, loaning, trading, selling/re-selling access to the GST portal or related data of GST portal.

- Selling, sponsoring, or otherwise monetizing any GST portal Service or feature without GSTN's direct and express consent.

- Soliciting or collecting email addresses or other personal information of GST portal users or GSTN users in any manner.

- Using, disclosing or distributing any data obtained in violation of this policy.

We are of opinion that this change in policy will not make any changes to users already scrapping the site. GSTN should not only issue warning but make sure that strong technology is implemented to avoid such misuses.

Further, GSTN should stop competing with private players directly with wrong information on its site.

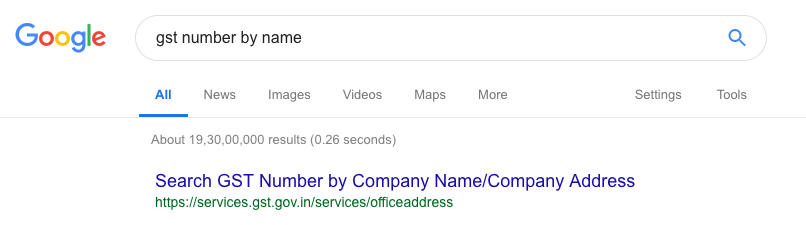

For example, GSTN itself is trying to mislead users with its wrong practices. Here is one example. If you search on Google for GST number by name, GST portal shows on the list.

You can see live example, GST portal is misleading tax payers by creating wrong pages. If you click on this link, instead of facility to search tax payers, you will get search facility of GST officers.

You can see live example, GST portal is misleading tax payers by creating wrong pages. If you click on this link, instead of facility to search tax payers, you will get search facility of GST officers.

We believe that no one should do wrong acts on GST portal but GST portal and GSTN should also stop misleading tax payers.

Related News

GSTR-9 and GSTR-9C due date extended

Due dates extended

GSTR9 and GSTR-9C for FY 2017-18 extended

Eway bill blocking is harassment

GST Annual return in form GSTR-9 removed

GSTR-9 and GSTR-9C due date extended

Government to refund money for technical errors to taxpayers

Forthcoming changes in e-Waybill system (Date: 25-03-2019)

GSTR-3B due date is extended

GST registration turnover limit to be increased to 40 lakhs

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by