Late Fee Gstr-1 Started And Tax Payers Are Shocked

Reported under GST on 11/12/2018GST portal has started showing warning for late filing fee on GSTR-1 and late fee is being charged now. Till now late filing fee was charged only on delay in filing of GSTR-3B.

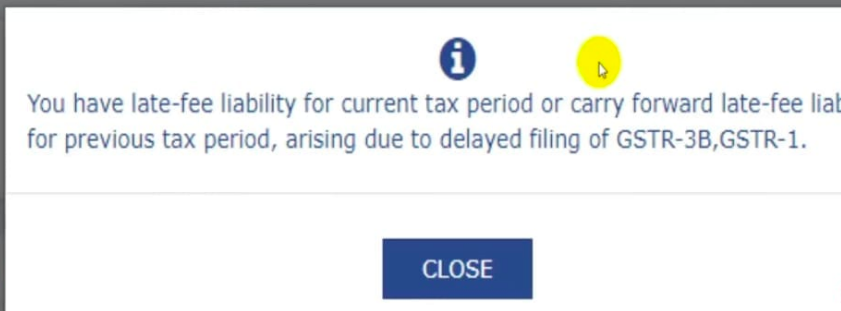

However from today many taxpayers have started seeing pop up for late filing fee on GSTR-1.

Our team believes it is time that government rethink its strategy to make GST successful in India. Today results of 3 states were announced and public has shown anger on current government.

Half of the time site is down or GST laws and rules are not made very clear. Time of taxpayers is wasted but no compensation is paid for that and government is collecting late fee for every form now.

It is advised to tax payers and consultants to file their returns on time as there is no provision to waive late filing fee after due date unless announced and waived for all tax payers.

Consultants are already complaining about various malfunctions on site and this is going to be an extra financial burden on them.

We request government to waive fee on GSTR-1 till this month and from next month government can charge the fee as still GST is in implementation mode and government should not meet its collection target by charging heavy late filing fee.

Here is the screen shot of GSTR-1 late filing fee.

Related News

GSTR-9 and GSTR-9C due date extended

Due dates extended

GSTR9 and GSTR-9C for FY 2017-18 extended

Eway bill blocking is harassment

GST Annual return in form GSTR-9 removed

GSTR-9 and GSTR-9C due date extended

Government to refund money for technical errors to taxpayers

Forthcoming changes in e-Waybill system (Date: 25-03-2019)

GSTR-3B due date is extended

GST registration turnover limit to be increased to 40 lakhs

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by