Gstr-9 Due Date Is Extended, New Due Date Is March 31,2019

Reported under GST on 08/12/2018CBIC has extended the due to file GST Annual Returns. GST annual return is a final statement for a financial year to be filed by every registered tax payer and earlier due date was 31, December 2018.

The move to extend due date was expected as even department website for filing returns was not even ready and various industrial bodies as well as professional had on going demands to extend due dates as forms were announced late.

GST department and council bodies have been making life of tax payers and professionals miserable. The annual return forms were announced very late and even audit forms and requirements were announced very late.

Annual Return in form 9 is not made available online for filing even till date. The extension for filing annual returns was expected and has been announced.

What is the new due date of filing GSTR-9 annual returns after extension?

The new due date to file annual returns is 31 March 2019.

Taxpayers have been given 3 months extension to file GSTR-9. As per notification due date for GSTR-9, GSTR-9A and GSTR-9C has been extended till March 2019.

GSTR-9 is to be filed by every Taxpayer, while GSTR-9B is for composition dealer and form GSTR-9C is applicable to those who have to get books audited by a Chartered Accountant or Cost Accountant.

Here is the notification for download and view issued by CBIC for due date extension of GSTR-9 (GST Annual Returns).

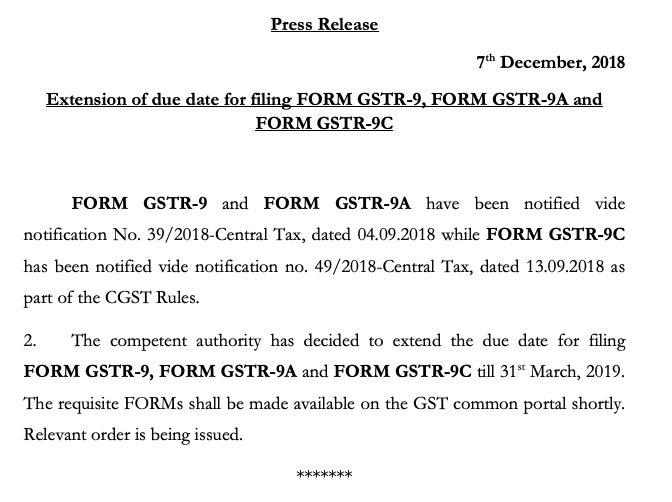

Press Release

7 th December, 2018

Extension of due date for filing FORM GSTR-9, FORM GSTR-9A and FORM GSTR-9C FORM GSTR-9 and FORM GSTR-9A have been notified vide notification No. 39/2018-Central Tax, dated 04.09.2018 while FORM GSTR-9C has been notified vide notification no. 49/2018-Central Tax, dated 13.09.2018 as part of the CGST Rules.

2. The competent authority has decided to extend the due date for filing FORM GSTR-9, FORM GSTR-9A and FORM GSTR-9C till 31st March, 2019. The requisite FORMs shall be made available on the GST common portal shortly. Relevant order is being issued.

*******

Download GSTR-9 annual return date extension notification.

Related News

GSTR-9 and GSTR-9C due date extended

Due dates extended

GSTR9 and GSTR-9C for FY 2017-18 extended

Eway bill blocking is harassment

GST Annual return in form GSTR-9 removed

GSTR-9 and GSTR-9C due date extended

Government to refund money for technical errors to taxpayers

Forthcoming changes in e-Waybill system (Date: 25-03-2019)

GSTR-3B due date is extended

GST registration turnover limit to be increased to 40 lakhs

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by