Government To Refund Money For Technical Errors To Taxpayers

Reported under GST on 01/04/2019Elections are approaching and central government is in mood to impress GST tax payers. Businessmen are angry with government as it has charged late filing fee but did not compensate for technical errors on GST website.

We discussed with many registered GST tax payers and chartered accountants. Here is what a chartered accountant had to say.

We have lost many hours due to technical errors on GST website. We hardly get any money for GST returns but all time goes in trying to get GST website working. We hope government pay us for all time lost on website.

This is similar to what many consultants said to us.

However, now government do not want to disappoint consultants and tax payers and have decided to pay for its own faults. Government officials have said that their AI (Artificial Intelligence) powered servers have calculated time lost by each tax payer and accordingly they will pay.

Question was asked whether the money will be recovered from Infosys (company handling tech part of GSTN), government officials said money will be paid from tax collected.

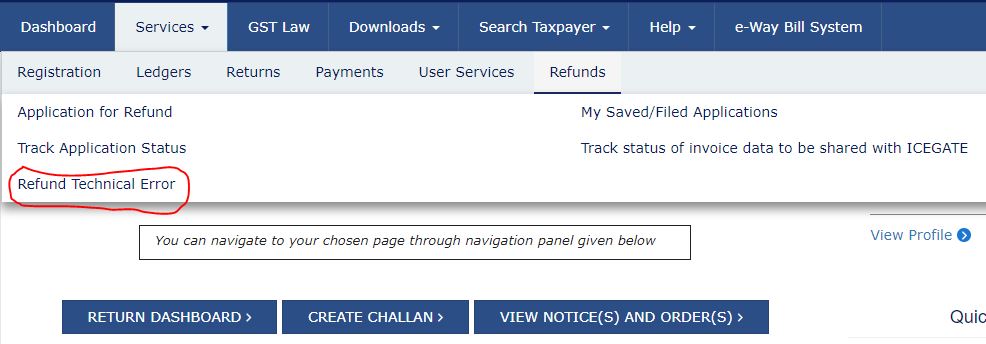

Surprisingly now you can apply for refund, the amount is auto calculated. To apply for refund you need to follow these steps.

- Login to GST website.

- Click on Services

- Click on Refunds

- Click on Refund Technical Error

Refunds are targeted to be released in 7 working days. Once you have applied for refund, you can assign refund to either your own account or your consultant's account.

It was an April Fool Joke. Don't hope for money from government, never unless you have your votebank.

Related News

GSTR-9 and GSTR-9C due date extended

Due dates extended

GSTR9 and GSTR-9C for FY 2017-18 extended

Eway bill blocking is harassment

GST Annual return in form GSTR-9 removed

GSTR-9 and GSTR-9C due date extended

Forthcoming changes in e-Waybill system (Date: 25-03-2019)

GSTR-3B due date is extended

GST registration turnover limit to be increased to 40 lakhs

What is wrong with GST council? A bad move to further damage government reputation.

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by