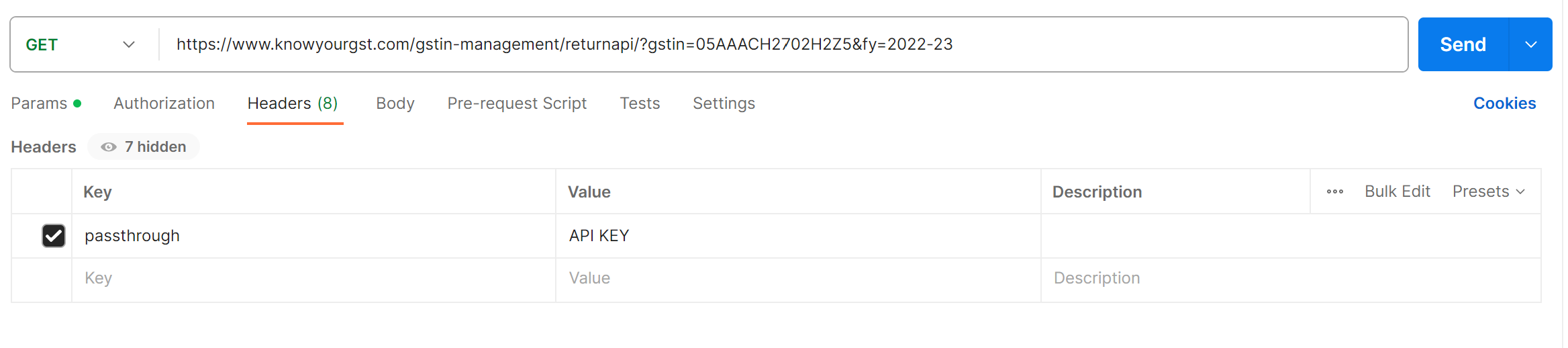

With valid subscription and balance, use below url, params and headers.

URL : https://www.knowyourgst.com/gstin-management/returnapi/?gstin=05AAACH2702H2Z5&fy=2022-23Params : gstin="gstnumber" & fy = financial yearheaders : passthrough : "API KEY"

Examples:

Postman

Python request

import requests

url = "https://www.knowyourgst.com/gstin-management/returnapi/?gstin=05AAACH2702H2Z5&fy=2022-23"

payload = {}

headers = {

'passthrough': 'API KEY'

}

response = requests.request("GET", url, headers=headers, data=payload)

print(response.text)

PHP

$curl = curl_init();

curl_setopt_array($curl, array(

CURLOPT_URL => 'https://www.knowyourgst.com/gstin-management/returnapi/?gstin=05AAACH2702H2Z5&fy=2022-23',

CURLOPT_RETURNTRANSFER => true,

CURLOPT_ENCODING => '',

CURLOPT_MAXREDIRS => 10,

CURLOPT_TIMEOUT => 0,

CURLOPT_FOLLOWLOCATION => true,

CURLOPT_HTTP_VERSION => CURL_HTTP_VERSION_1_1,

CURLOPT_CUSTOMREQUEST => 'GET',

CURLOPT_HTTPHEADER => array(

'passthrough: API KEY'

),

));

$response = curl_exec($curl);

curl_close($curl);

echo $response;

Nodejs

var request = require('request');

var options = {

'method': 'GET',

'url': 'https://www.knowyourgst.com/gstin-management/returnapi/?gstin=05AAACH2702H2Z5&fy=2022-23',

'headers': {

'passthrough': 'API KEY'

}

};

request(options, function (error, response) {

if (error) throw new Error(error);

console.log(response.body);

});

Response

{

"EFiledlist": [

{

"valid": "Y",

"mof": "ONLINE",

"dof": "19-03-2023",

"ret_prd": "022023",

"rtntype": "GSTR3B",

"arn": "AA0502231430511",

"status": "Filed"

},

{

"valid": "Y",

"mof": "GSP",

"dof": "09-03-2023",

"ret_prd": "022023",

"rtntype": "GSTR1",

"arn": "AA050223041913M",

"status": "Filed"

},

{

"valid": "Y",

"mof": "ONLINE",

"dof": "19-02-2023",

"ret_prd": "012023",

"rtntype": "GSTR3B",

"arn": "AA050123154395I",

"status": "Filed"

},

{

"valid": "Y",

"mof": "ONLINE",

"dof": "08-02-2023",

"ret_prd": "012023",

"rtntype": "GSTR1",

"arn": "AA050123058109K",

"status": "Filed"

},

{

"valid": "Y",

"mof": "ONLINE",

"dof": "19-01-2023",

"ret_prd": "122022",

"rtntype": "GSTR3B",

"arn": "AA051222205830V",

"status": "Filed"

},

{

"valid": "Y",

"mof": "ONLINE",

"dof": "07-01-2023",

"ret_prd": "122022",

"rtntype": "GSTR1",

"arn": "AA051222046057O",

"status": "Filed"

},

{

"mof": "ONLINE",

"dof": "27-12-2022",

"ret_prd": "032022",

"rtntype": "GSTR9C",

"arn": "AA050322376631G",

"status": "Filed"

},

{

"mof": "ONLINE",

"dof": "21-12-2022",

"ret_prd": "032022",

"rtntype": "GSTR9",

"arn": "AA0503223697941",

"status": "Filed"

},

{

"valid": "Y",

"mof": "ONLINE",

"dof": "19-12-2022",

"ret_prd": "112022",

"rtntype": "GSTR3B",

"arn": "AA051122138437J",

"status": "Filed"

},

{

"valid": "Y",

"mof": "ONLINE",

"dof": "08-12-2022",

"ret_prd": "112022",

"rtntype": "GSTR1",

"arn": "AA051122045232Z",

"status": "Filed"

},

{

"valid": "Y",

"mof": "ONLINE",

"dof": "19-11-2022",

"ret_prd": "102022",

"rtntype": "GSTR3B",

"arn": "AA0510221314710",

"status": "Filed"

},

{

"valid": "Y",

"mof": "GSP",

"dof": "07-11-2022",

"ret_prd": "102022",

"rtntype": "GSTR1",

"arn": "AA051022034673Q",

"status": "Filed"

},

{

"valid": "Y",

"mof": "ONLINE",

"dof": "19-10-2022",

"ret_prd": "092022",

"rtntype": "GSTR3B",

"arn": "AA0509221911581",

"status": "Filed"

},

{

"valid": "Y",

"mof": "ONLINE",

"dof": "07-10-2022",

"ret_prd": "092022",

"rtntype": "GSTR1",

"arn": "AA050922042022S",

"status": "Filed"

},

{

"valid": "Y",

"mof": "ONLINE",

"dof": "20-09-2022",

"ret_prd": "082022",

"rtntype": "GSTR3B",

"arn": "AA050822136044L",

"status": "Filed"

},

{

"valid": "Y",

"mof": "ONLINE",

"dof": "06-09-2022",

"ret_prd": "082022",

"rtntype": "GSTR1",

"arn": "AA050822031773C",

"status": "Filed"

},

{

"valid": "Y",

"mof": "ONLINE",

"dof": "19-08-2022",

"ret_prd": "072022",

"rtntype": "GSTR3B",

"arn": "AA050722133101Y",

"status": "Filed"

},

{

"valid": "Y",

"mof": "ONLINE",

"dof": "07-08-2022",

"ret_prd": "072022",

"rtntype": "GSTR1",

"arn": "AA050722034157H",

"status": "Filed"

},

{

"valid": "Y",

"mof": "ONLINE",

"dof": "19-07-2022",

"ret_prd": "062022",

"rtntype": "GSTR3B",

"arn": "AA0506221870981",

"status": "Filed"

},

{

"valid": "Y",

"mof": "ONLINE",

"dof": "07-07-2022",

"ret_prd": "062022",

"rtntype": "GSTR1",

"arn": "AA0506220466195",

"status": "Filed"

},

{

"valid": "Y",

"mof": "ONLINE",

"dof": "18-06-2022",

"ret_prd": "052022",

"rtntype": "GSTR3B",

"arn": "AA050522119201Y",

"status": "Filed"

},

{

"valid": "Y",

"mof": "ONLINE",

"dof": "08-06-2022",

"ret_prd": "052022",

"rtntype": "GSTR1",

"arn": "AA050522042316N",

"status": "Filed"

},

{

"valid": "Y",

"mof": "ONLINE",

"dof": "20-05-2022",

"ret_prd": "042022",

"rtntype": "GSTR3B",

"arn": "AA050422123333V",

"status": "Filed"

},

{

"valid": "Y",

"mof": "ONLINE",

"dof": "08-05-2022",

"ret_prd": "042022",

"rtntype": "GSTR1",

"arn": "AA050422038337H",

"status": "Filed"

},

{

"valid": "Y",

"mof": "ONLINE",

"dof": "19-04-2022",

"ret_prd": "032022",

"rtntype": "GSTR3B",

"arn": "AA050322179280K",

"status": "Filed"

},

{

"valid": "Y",

"mof": "ONLINE",

"dof": "08-04-2022",

"ret_prd": "032022",

"rtntype": "GSTR1",

"arn": "AA0503220556299",

"status": "Filed"

}

]

}

What is GST return API?

GST Return API is used to get the details of GST returns filed by a GST number. You can fetch details of any GST numbers and check which all returns are filed and when.

Which all GST returns are part of response?

Response will provide details of GST returns filed by GSTIN user except annual return. Response contains details of all monthly and quarterly returns. GSTR-1, GSTR-3B, GSTR-7 etc. are part of response.

Will API provide details of all latest returns filed by GSTIN user?

Yes, API provides real time data. Even return files today, will be part of response. Further, API will provide response with details such as Mode of filing, Return type, date of filing, Return ARN, Return period and status.