Corruption And Frauds Under Gst That Can Break Your Business

Reported under GST on 30/11/2018Goods and Services Tax or GST, the most promising step taken to ease indirect taxation in India. However the implementation has many loopholes that can result in closer of your business.

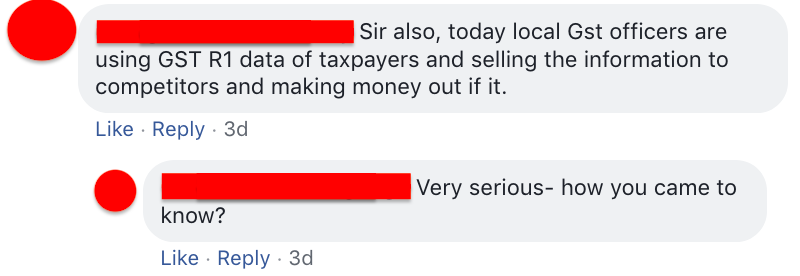

Before discussing various possibilities of wrong doings and how to tackle it, here is a screen shot of what a consultants and tax payers are facing.

This is a very tough situation for tax payers to avoid. Even corrupted GST officers are selling your GSTR-1 data to your competitors.

Data is the new oil. : Mukesh Ambani

This is what Mukesh Ambani believes in. Yes, data is the new oil and everyone needs it. People can make money from data and they are doing it.

There are 2 type of data.

- Private and confidential data

- Public data

Under GST your GST number is a public data and anyone can view details. Every other details like your sales, purchase, tax payments etc. are your private and confidential information.

If you think your private data is not shared with your competitors, you are wrong. Your data is available for sale.

If you getting a product for free then you are a product

Nothing comes for free, if you are using a product, there is cost involved to make product and product has to recover its cost plus profit. Take an example of Facebook or Google Search, they are free but make money by using your personal information.

We being a community of Tax professional at KnowyourGST, let's understand how tax data is used in different ways.

There is a big website, in fact largest site that provides free Income Tax filing, GST filing and gets users by writing articles on site. You clearly know about the site. The site is cleartax. I am just giving one example, there are many site that do similar things.

Once a user files income tax using cleartax or any other site, you become a product for them. These site use this data to sale credit card, loan offers, investment proposals. This is how you become a product by using free products.

How to avoid business information leakage?

By now you are aware, how companies can make crores by selling your personal information. Now biggest question is how to avoid leakage of your business information.

First, let's understand what information could get leaked.

- Your GSTR-1 return data

- Your GSTR-2 return data

- Your IT information

- Your manufacturing recipe

- Many other confidential details

If your competitor gets your GSTR-1 data, he can easily get the details of all your customers. Not only details of customers but even pricing details.

Your competitor can approach your customers and sell products at lower rate. Once your GSTR-1 data is leaked, your business will have major risk of closure.

Your competitor if gets your GSTR-2 data, he can check what you are purchasing, details of your row materials to manufacture an item. He can identify you cost factors and create problem by interrupting in your supply chain management.

Your IT information is equally important for companies. Once your IT information is out, you will be bombarded with Credit car, loans and investment proposals. In some states, where criminal make use of this details to harm you by kidnapping etc.

There are multiple possibilities of misusing your critical business information.

However there are preventive steps you can take to avoid leakage of any of your personal information.

Do not use any free software

Yes, do not use any free software (specially online) to file you returns. I have witnessed many online software which are free and once you use them, you start getting lot of calls.

Do not use free or paid online software to file Income Tax returns. We Indian like free things, but there is a risk attached with every free thing you get.

Online free IT filing websites, gather your information and then start selling your information and believe me it's a very big market. Your information is sold for crores and you are biggest product for them.

Keep your information at your system

Any information that you have to share with government, remember to file it through your system. Even if you are using any third party tool, remember to check their data policy and what they can do with your data.

Most of time data is sold without your permission and no one is going to tell it on your face but that's how business works.

Even if it takes 1 hour extra, make sure you do it on your system.

You will save yourself from data theft. Though still GST officers can sell your data, you have no control there. But whenever you come to know about it, make sure to report it.

Conclusion

Your business is your responsibility and securing your critical information is your bigger responsibility. With ease of doing business, comes the ease of data theft.

You have to take steps to prevent any of your data leakage.

Do not look at small costs, by saving small amounts you risking your entire business.

Just think of a scenario where your competitor gets your GSTR-1 data, how easy it will be for him to snatch your customers. He will know exact rate you are selling at and to whom you are selling.

Note: I have used few names here, this is just for information purpose, most of research can be done at your end. By selling of data, I mean selling directly or indirectly or making use of data to push products directly to you or your competitors.

Related News

GSTR-9 and GSTR-9C due date extended

Due dates extended

GSTR9 and GSTR-9C for FY 2017-18 extended

Eway bill blocking is harassment

GST Annual return in form GSTR-9 removed

GSTR-9 and GSTR-9C due date extended

Government to refund money for technical errors to taxpayers

Forthcoming changes in e-Waybill system (Date: 25-03-2019)

GSTR-3B due date is extended

GST registration turnover limit to be increased to 40 lakhs

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by