I have received a notice from PT department regarding payment of professional Tax for the year 2019-20. I am registered under GST.

Here is the wordings of notice.

NOTICE UNDER SECTIONS 5(2), 7(3) AND 11 (3) OF THE KARNATAKA TAX ON PROFESSIONS, TRASES, CALLINGS AND EMPLOYMENTS ACT,1976

Please, take notice that, you being a registered tax payer under Karnataka Goods and Service Tax Act, 2017 but not enrolled under section 5(2) of KTPTC& E Act, 1976, and hence you are required to enrol, to pay Profession tax and file return in Form-6A(4) every year on or before 30th April. But, upon verification of your payment account in VAT e-FS system, it is noticed that you have neither Enrolled nor paid Professional Tax and not filed the return for the following years which has warranted initiation of this proceedings to collect the applicable tax along with interest at 1.25% per month from the date of due till the date of tax payment.

My question are:

- How much Professional Tax should be paid in Karnataka?

- What is the procedure to pay professional tax?

Professional Tax or PT is payable on yearly basis. Amount of tax depends on turnover limit and maximum is Rs. 2500 for a year.

Due date for paying professional tax (PT) in Karnataka is 30th April of each year. For financial year 2019-20 due date is 30/04/2019.

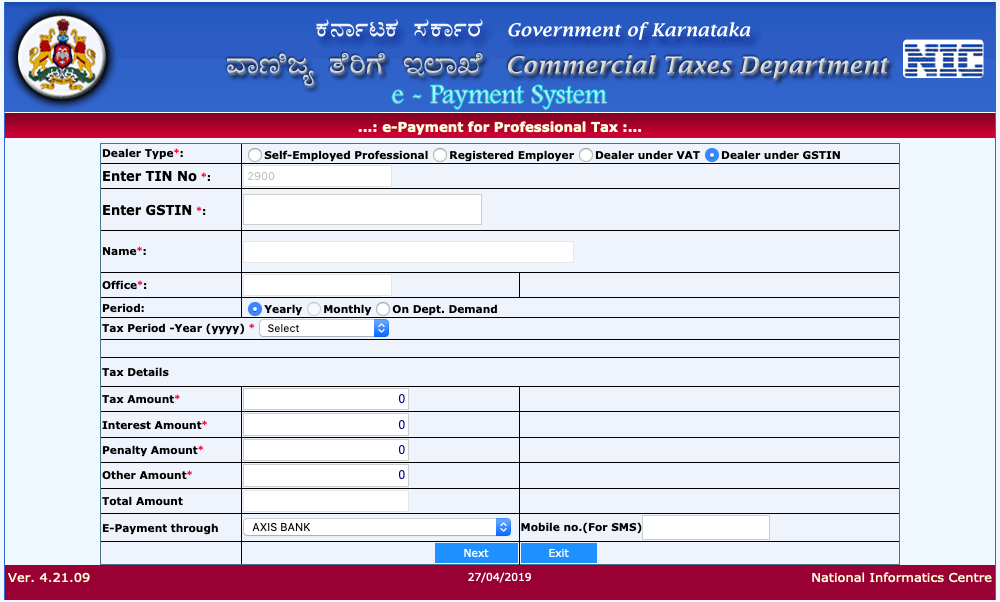

Procedure to Pay PT in Karnataka is as follow:

- Visit Karnataka commercial Tax website payment page.

- Click on KPT (Karnataka Professional Tax)

- Click on Dealer under GSTIN

- Fill your GST Number

- Select Period Yearly

- Tax Period should be 2019-20

- Fill tax amount (2500) in most cases

- Select your Bank

- Click on Next

- Verify the details and click on Submit button

- Copy reference number

- Click on "Click here for Payment" button

- Pay through your bank account

The process is pretty simple and straight forward. If you have any doubt, please use comment box.

In verfiy, I am getting "y" in status and payment is recived in payment gateway . And getting successful

JOIN LARGEST DISCUSSION PLATFORM

Sign up to discuss taxation, accounting and finance topics with experts from all over India.

Join Discussion