What is the procedure to generate E-way bill in Rajasthan?

How to issue eway bill and what are the conditions for issuing eway bill? Do we have to register on GST website or there is separate website for generating eway bill in Rajasthan?

Eway bill is the electronic receipt of movement of goods for supply.

You have to generate eway bill every time goods are moved from one place to another whether from your own branch to branch transfer or for sale.

Validity of eway bill generated is based on distance.

| 1 | Less than 100 km | 1 Day |

| 2 | 100 km or more but less than 300 km | 3 Days |

| 3. | 300 km or more but less than 500 km | 5 Days |

| 4. | 500 km or more but less than 1000 km | 10 Days |

| 5. | 1000 km or more | 20 Days |

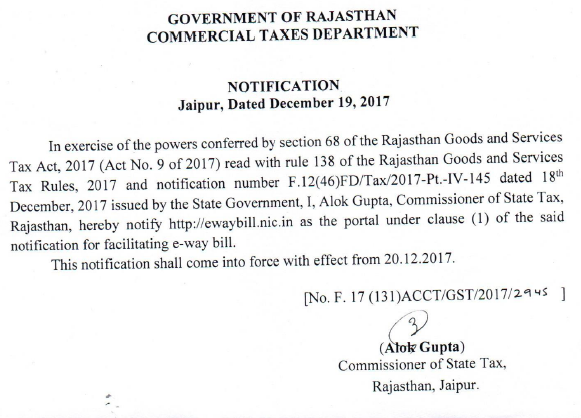

E-way bill rules are notified and made applicable in Rajasthan from 20 December, 2017.

To generate E-way bill you have to visit eway bill website and register with your GST number.

After registration you can issue E-way bill. The procedure to register and issue E-way bill is similar to registration for eway bill in Karnataka.

Website to generate eway bill in rajasthan.

Website to generate eway bill is ewaybill.nic.in

Eway bill is compulsory for every sale transaction?

For every invoice value more than 50,000 eway bill has to be issued and for interstate transactions there is no limit (need to confirm but in Karnataka Eway bill required for interstate transactions).

Below is the notification number 2946 date 19/12/2017.

JOIN LARGEST DISCUSSION PLATFORM

Sign up to discuss taxation, accounting and finance topics with experts from all over India.

Join Discussion