A complete guide on VAT in United Arab Emirates (Dubai)

Last udpated: Nov. 23, 2017, 9:13 a.m.VAT is proposed to be implemented in UAE from January 2018.

We in India have vast experience of handling indirect taxes. We had all possible indirect taxes, may it be taxes on services (service tax), taxes on manufacturing (Excise) or taxes on trading (VAT). Latest tax we migrated to is GST (Goods and Services tax).

It is not only an excellent opportunity for Indian professional in India, but businesses in UAE to get maximum benefits from expertise and experience of Indians in this field.

Here is an overview of the VAT laws in united Arab Emirates (UAE).

What is VAT and how it is different from sales tax?

From a consumers point of view there is not major difference between VAT and sales tax. However for businesses the major difference is that sales tax is charged at the consumption points, whereas VAT will be charged at each point of supply chain.

To understand it better, let us consider below example.

Mr. A sold certain goods to Mr. B. Mr. B sold the goods to Mr. C and Mr. C sold the goods to ultimate consumer.

Here Mr. A can be a manufacturer, B distributor and C retailer.

Under everyone, from Mr. A to Mr. C has to charge VAT on each transaction.

Mr. A will charge VAT, when goods are sold to Mr. B. Mr. B will charge VAT when goods are sold to Mr. C and Mr. C will collect tax from consumer.

How the VAT cycle will flow and how much tax needs to be paid to government?

The good things is that rate of tax is kept very low at 5% on goods and services.

VAT being indirect tax, businesses will have not impact on costing due to availability of input tax credit.

Businesses charging VAT have to pay tax to government after setting off the input tax credit.

Let us understand this with an example.

Mr. A purchase goods worth 100 from Mr. X and paid 5 UED as VAT.

Mr. A sold these goods for 200 UED and charged 10 UED as VAT.

Now Mr. A has to pay 5 UED (10-5) to government.

What are the documents required to be maintained under VAT and for how many year documents needs to be preserved?

Businesses will have to maintain documents which will enable authorities to check correctness of vat compliance.

For example, every business need to maintain following documents, information and records.

- All purchase invoices

- Sales invoices

- Returns

- Purchase register

- Sales register

- Tax ledgers etc.

Businesses need to keep these documents for 5 years.

Who are required to register under VAT in UAE?

One has to compulsory register under UAE VAT if taxable turnover and imports exceeds AED 375,000.

However one can also register under VAT if imports and supplies together though are less than AED 375,000 but exceed AED 187,500. Further business can also register if expenses exceed 375,000 AED.

What are the compliance one need to comply with after VAT registration?

A registered business, need to maintain proper records and information for verification by authorities. Business should file timely VAT returns and should make timely tax payments.

Business once registered has to charge VAT on every taxable supply.

What is the procedure for VAT registration in UAE?

The registration is made really simple. One can register online by going to VAT portal of UAE government.

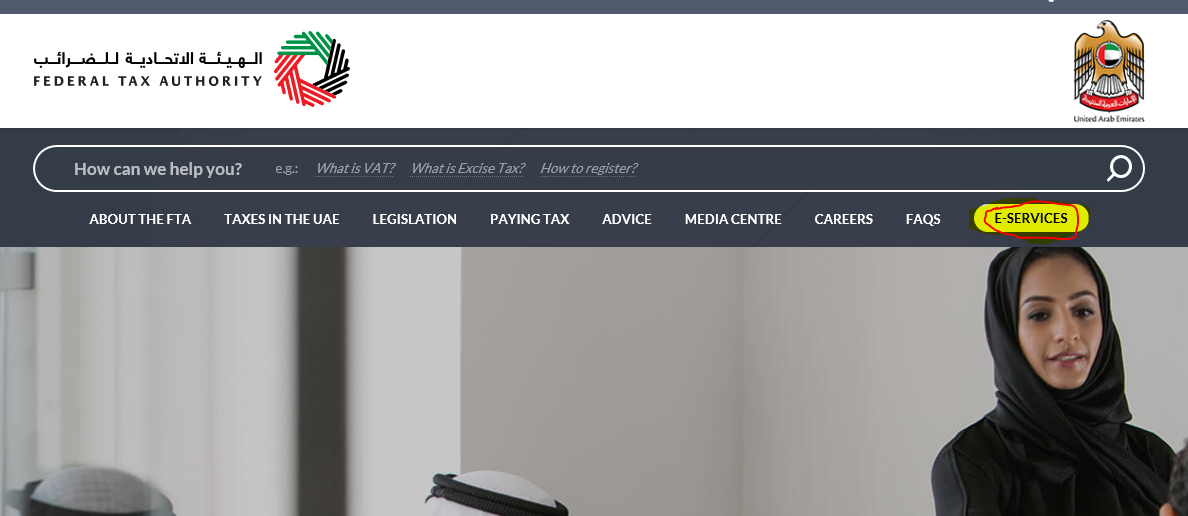

To register for VAT you have to first go to UAE tax website (https://tax.gov.ae/index.aspx).

Once on website, you will have various options.

Click on E-SERVICES.

Login screen will open, create the account and login to your account.

After successful login, Click on 'Create a new tax request'.

Fill up the details.

Submit the form after payment of government fee. Fee can be paid online.

What the documents or information required for VAT registration in Dubai?

Following documents are required to be provided for VAT registration.

- Trade license

- Certificate of incorporation

- Emirates ID

- Articles of Association

- Bank Account details

- Description of business activities

- Last 12 months turnover

- Projected future turnover

- Expected values of imports and exports

- Expecting any GCC supplies

- Details of Customs Authority Registration

Conclusion

VAT implementation is going to be very smooth and hassle free in UAE for various reasons such as:

- Availability of consultants.

- Many Indian chartered accountants are available in UAE who have good experience in indirect taxes.

- Major work force in Arab countries belongs to countries where VAT and other indirect taxes are already collected, they can be utilised by UAE businesses to comply with VAT laws.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- Digital Signature

- How to find clients - A guide and experience study for GST Practitioners

- How to avoid frauds in online shopping?

- प्रधानमंत्री मुद्रा योजना | मुद्रा लोन योजना | Pradhan Mantri Mudra Yojana in Hindi

- Job portal for accounting and financial professionals

- Become a MS Excel superstar at your office

- Become a super hero - Help people understand complex tax laws

- Professionals classified listing to search legal and tax experts in India

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

No comments yet, be first to comment.